Dedicated to You

Means Test

The California means test compares a debtor’s total household income to the median income for a household of the same size, assessing qualification for Chapter 7 bankruptcy. Those with incomes above the median may review their assets and expenses to explore potential eligibility.

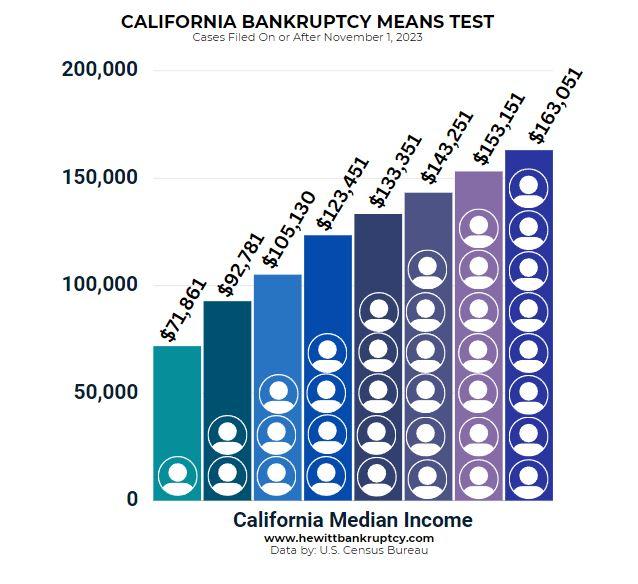

California Median Income (Only for Cases filed After Nov 1, 2023)

1 Person Household: $71,861

2 Person Household: $92,781

3 Person Household: $105,130

4 Person Household: $123,451

*Add $9,900 for each additional household member over 4

As a Riverside bankruptcy attorney, I have helped thousands pass the means test. I can usually tell you over the phone during your free consultation if you will pass the means test. Visit our Riverside, San Clemente, or Palm Desert offices for a face-to-face meeting to explore your bankruptcy options.

For some people, the means test does not apply. If you are a business debtor, then you fall into this category. That means that if over 50% of your debt is business-related, then the means test does not apply, and you can get a Chapter 7 bankruptcy much more easily than other high-income earners. The other exception to the means test is if you have high expenses and can show you have no disposable monthly income to pay into Chapter 13. The expenses must be involuntary and a direct necessity for life, such as an expensive mortgage, high medical bills, spousal support, or other eligible expenses.

Your Current Monthly Income (CMI) is your average monthly gross income over the past six months, which is calculated and then annualized. Below, I will show you how to calculate your CMI. This figure is compared against the median income for a household of your size in California. If your income is below the median, you automatically qualify for Chapter 7 bankruptcy. If your income is marginally above the median, you must analyze your assets and expenses in detail. The U.S. Census Bureau annually determines median income. Debtors who cannot pass the means test must pay back unsecured creditors at least a portion of their debt through a Chapter 13 reorganization plan.

If your income is above the median, you must complete the second part of the test. This involves a detailed examination of your income and expenses to determine if you have enough disposable income to repay some of your debts. Certain standardized expenses, such as living costs, taxes, and healthcare, as well as actual expenses like mortgage and car payments, are deducted from your income to calculate your disposable income. In 2005, congress introduced The Bankruptcy Abuse and Consumer Prevention Act (BAPCPA), which was created to ensure only debtors who cannot afford to repay unsecured debts would be eligible for Chapter 7 by setting the standard of living costs. The I.R.S. determines these deductions for the state level, and the U.S. Trustee sets county levels. I have created a complete breakdown of allowable expenses for Riverside, Orange, San Bernardino, and Los Angeles Counties.

To calculate your CMI, you must include every source of income, including overtime, part-time work (Uber, Lyft), and any businesses you own or have a stake in. All working adults’ financial contributions to the household must be included unless it is a spouse jointly filing. For example, if you have a roommate paying $500 a month for rent and you are paying the housing bill, this is considered a source of income and must be listed on form 122A-1.

Sources of income Included in the means test:

- Wages, tips & commissions

- Alimony and child support (Applies if the payer is not filing jointly)

- Contributions to household from spouse, roommate, family, etc.

- Net income from a business, profession, or farm.

- Net income from rental properties and real property

- Interest, dividends, and royalties, including profits from stock or crypto sales and trades.

- Unemployment Compensation (Unless a benefit under the Social Security Act)

- Pension or retirement income (Exceptions are listed below)

- Any other sources not mentioned

Sources of income Excluded from the means test:

- Social Security Benefits

- Any compensation or payment provided by the U.S. Government in connection with a Uniformed Services member.

- Physical Disability: Retired pay under Chapter 61 of Title 10 is protected up to what you would get under another provision of Chapter 10.

Means Test for Married Couples

Married couples can either either file jointly or file separately. There are situations to take into consideration before making this decision. The trustee prefers married couples living together to have their financials separated if only one debtor is filing. A couple who filed their tax returns together but only one debtor wants to file will need to talk to their attorney about how to present this to the trustee. If your bank and credit cards are joint accounts, filing bankruptcy together will make the process easier. However, the spouse not filing can pay off their portion of the credit card balance before filing. One upside to only one debtor filing is that your spouse will retain their credit score, which can be helpful. If the debtor filing is the household’s breadwinner, filing jointly will increase the allowable income limits.

Number of People in Your Household

The number of people in your household will include all family members who are dependents and are financially reliant on you. Expenses paid by the debtor necessary to care for disabled, elderly, or ill members of the immediate family are acceptable. Trustees may, however, ask you to show these financial records in detail to prove your expenses. Immediate family only includes children, parents, grandparents, and siblings. Stepchildren can be included if it is a joint filing with the parent of your stepchildren. Adult children (18+) can be a point of contention as they may be expected to at least pay for their household expenses in the eyes of the trustee.

When Should You File for Bankruptcy?

Some factors that many people facing bankruptcy don’t usually consider are documentation and timing. It is surprising how many debtors fall somewhere close to the line of passing or failing the means test. Your attorney will always recommend filing a Chapter 7 bankruptcy if you are below the median income. When your income is close to the median income for the size of your Household, an experienced attorney will take the time to understand your situation and be in a better position to negotiate with the trustee why you file the way they suggest. The timing matters if you recently made six figures but just retired. In the future, you won’t ever be seeing those extensive checks again, and an experienced attorney who knows the ins and outs of the Riverside court system will suggest what they see the trustee will understand. Perhaps waiting for a few months before you file is the best route for you. Each case is unique and different, and your lawyer must consider all your data and how it applies to the law to get the best outcome for the client.

While bankruptcy is a path to debt relief, exploring all alternatives is essential. If Chapter 7 is out of reach, Chapter 13 offers a structured repayment plan, allowing you to regain your financial footing over several years. To make informed decisions in your bankruptcy journey, consult experts who can demystify the means test and guide you towards the right path.

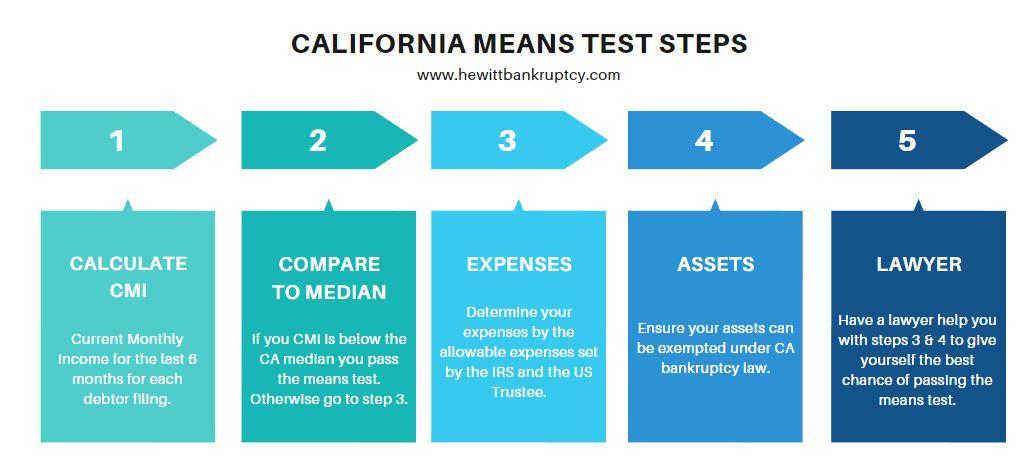

Step-by-Step Guide to the Bankruptcy Means Test for Personal Bankruptcy in California

Understanding the means test is crucial if considering personal bankruptcy in California. This step-by-step guide will walk you through determining your eligibility for Chapter 7 or Chapter 13 bankruptcy.

Step 1: Compare Your Income to Median Income

Begin by comparing your average monthly income to the median Income in California for your household size. Consider all family members and all of their incomes. Describe this to your attorney so they can fully understand the dynamics of your Household and your actual costs to maintain a roof over your family’s head and keep food on the table. The income may be from a single source or multiple family members’ incomes, depending on your situation.

Step 2: Determine Allowable Expenses

If your income exceeds the median, you’ll need to explore further. Deduct allowable expenses from your income, including secured debts like mortgages and car payments. These expenses help calculate your disposable monthly income, which affects your eligibility. Having good documentation is critical when you are close to the line. The appointed trustee will be the representative of the creditor. Having the ability to show the trustee why your circumstances are different or unique and having clear paperwork to back it up will make your case more manageable and stronger.

Step 3: Calculate Disposable Income

Use this formula: Disposable Income = [(Current Monthly Income) – (I.R.S. Guideline Expenses) x 60]. If your disposable income is less than the current stated median in California, you pass the means test and can file for Chapter 7.

Step 4: Explore Chapter 13 as an Alternative

If your income exceeds the means test limits, consider Chapter 13 bankruptcy, which allows you to repay debts over three to five years. It’s particularly suitable for individuals with higher incomes.

Step 5: Understand Who is Exempt

There are a few exceptions for taking the required means test. Exemptions include disabled veterans, active-duty military personnel, and business debtors.

Step 6: Seek Legal Guidance

The means test can be complex and confusing. Consulting an experienced bankruptcy attorney in California can help you navigate the process, make informed decisions, and save money.

Our firm has included a Means Test Case Study.

Summary

Remember that this step-by-step guide aims to help you understand the process. Still, it’s advisable to consult with a legal professional to assess your unique financial situation and bankruptcy options accurately. With offices in San Clemente, Riverside, and Palm Desert, we can help many people across Southern California annually decide if bankruptcy is right for them. Please contact us for a free consultation, and you will speak directly with a lawyer who can give you a pretty good idea if you pass the means test within 15 minutes. It may take more time for some more complex cases, but having filed thousands of bankruptcy cases has allowed us to gain the experience to move quickly by knowing bankruptcy law inside and out.