Desert Hot Springs, California

Desert Hot Springs, located in the Coachella Valley of Southern California, is renowned for its unique natural hot mineral springs, believed to possess therapeutic properties. Just North of Palm Springs, Desert Hot Springs has a population of 39,000 people. The Law Office of Christopher Hewitt serves Riverside County clients and has a close office location to meet people who live in Desert Hot Springs.

Our Services:- Free Consultation and means test evaluation in Desert Hot Springs

- Legal Advice on whether to File Chapter 7 or Chapter 13 Bankruptcy in Desert Hot Springs

- Wage Garnishment Issues in Desert Hot Springs

- Debt Settlement or Debt Relief in Desert Hot Springs

- Foreclosure in Desert Hot Springs

History of Desert Hot Springs

History of Desert Hot SpringsDesert Hot Springs boasts a rich history centered around its renowned hot springs. The area was initially inhabited by the Cahuilla Native Americans, who utilized the natural hot springs for their therapeutic properties. In the early 20th century, the health benefits of these springs began to attract attention beyond the local population. L.W. Coffee, recognizing the potential of the hot springs, purchased land and established a health resort in the 1940s, laying the foundation for the city's development. The city was officially incorporated in 1963, spurred by the growing popularity of its hot mineral waters among those seeking health and relaxation. Throughout the years, Desert Hot Springs has grown into a unique desert community, maintaining its reputation for spa services and wellness tourism and leveraging its natural resources to foster a distinctive character among California's desert cities.

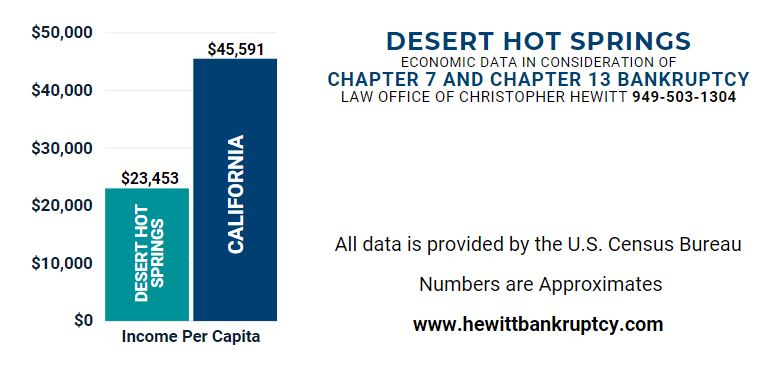

Economy of Desert Hot SpringsBankruptcy in Desert Hot Springs is widespread, with a 21% poverty rate. Desert Hot Springs's median household income is around $47,000, while the per capita income is $23,000. With incomes at this level, many automatically qualify for a Chapter 7 bankruptcy with the right to wipe out their debt and keep their property. Many people need to realize that you can keep your car and your house in bankruptcy and lose your unsecured debts. The median household income is around $46,000, which is way below the California median. The Home median value is surprisingly low for this part of Riverside County at $276,500.

Desert Hot Springs Bankruptcy is not only for individuals. Desert Hot Springs is only the second city to file bankruptcy as a municipality. The city was found guilty of a discrimination lawsuit and had to pay 3 million in damages. The city was able to come out of bankruptcy by securing bonds. Bankruptcy can be a way to fight a lawsuit, stop a wage garnishment, save a home, or figure out a way to pay a 3 million dollar judgment for the city of Desert Hot Springs.

Meet Your Riverside Bankruptcy LawyerOur Palm Desert office is only about 30 minutes from Desert Hot Springs. I come from our San Clemente office at least once a week, and you can set up a free consultation with me on the phone before our meeting.

Riverside County Bankruptcy Lawyer Christopher Hewitt Home

Riverside County Bankruptcy Lawyer Christopher Hewitt Home