Decades of Experience,

Dedicated to YouContact Us NowFor a Free Initial Consultation

341A Meeting of Creditors for Chapter 13

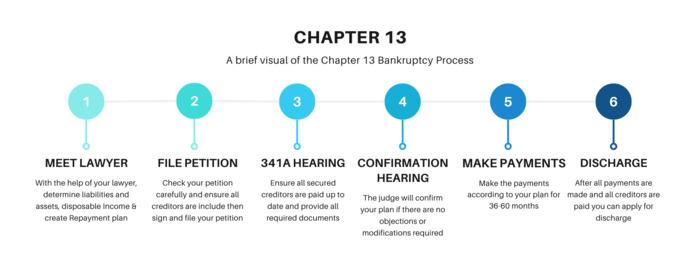

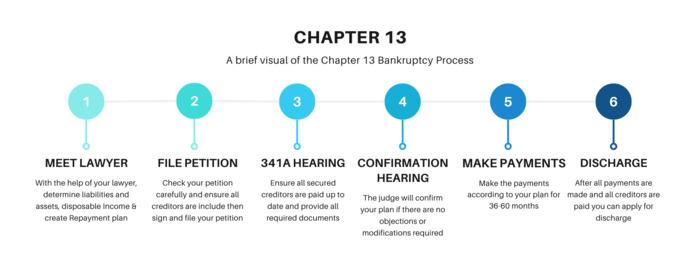

The purpose of a 341A meeting of creditors in a Chapter 13 bankruptcy is to enable the trustee to verify all of the debtor’s declared assets and liabilities, determine whether the proposed repayment is the best deal the creditors can get, ensure the debtor is up to date on their secured assets and will be fiscally able to make the suggested payments on the plan. Creditors can object or request modifications to the proposed plan.

I have been analyzing debtors' assets and liabilities to determine their ability to reorganize their debts for Chapter 13 bankruptcy for nearly 20 years. My vast experience as a bankruptcy lawyer has taught me how to create repayment plans that work for my clients and their creditors. If you are in debt and considering bankruptcy, contact me to analyze your situation together and determine your best reorganization options. My firm helps debtors file Chapter 13 bankruptcy in Riverside, Orange, San Bernardino, Los Angeles, and San Diego Counties.

Who will attend the meeting Every debtor on the Chapter 13 Voluntary Petition and their representing attorney must be present at the 341A meeting of creditors. Your spouse must also attend the meeting if they are included on the bankruptcy petition. The trustee appointed to your case will attend, and the trustee will conduct the meeting. All creditors listed on the petition will be invited to attend the meeting, but their attendance is optional. However, it is more likely for creditors to participate in a Chapter 13 meeting as they have an opportunity to recover funds.

Who will attend the meeting Every debtor on the Chapter 13 Voluntary Petition and their representing attorney must be present at the 341A meeting of creditors. Your spouse must also attend the meeting if they are included on the bankruptcy petition. The trustee appointed to your case will attend, and the trustee will conduct the meeting. All creditors listed on the petition will be invited to attend the meeting, but their attendance is optional. However, it is more likely for creditors to participate in a Chapter 13 meeting as they have an opportunity to recover funds.

Where and when will the meeting take place?

The meeting will take place either in person, by phone or by Zoom depending on the preference of the trustee when your case is filed. The court will send a meeting notification letter by mail to the address you have submitted on your petition. Typically the meeting will be 30-40 days after you have filed your bankruptcy petition.

I have been analyzing debtors' assets and liabilities to determine their ability to reorganize their debts for Chapter 13 bankruptcy for nearly 20 years. My vast experience as a bankruptcy lawyer has taught me how to create repayment plans that work for my clients and their creditors. If you are in debt and considering bankruptcy, contact me to analyze your situation together and determine your best reorganization options. My firm helps debtors file Chapter 13 bankruptcy in Riverside, Orange, San Bernardino, Los Angeles, and San Diego Counties.

Where and when will the meeting take place?

The meeting will take place either in person, by phone or by Zoom depending on the preference of the trustee when your case is filed. The court will send a meeting notification letter by mail to the address you have submitted on your petition. Typically the meeting will be 30-40 days after you have filed your bankruptcy petition.

What happens at the 341 MeetingTypically, up to ten meetings are scheduled for the same hour, so you must wait for the trustee to call your name. The trustee will verify your identity and swear you in. The trustee will likely have reviewed your repayment plan before the meeting. The trustee and creditors can ask questions about your financial status, employment, and payment ability. The trustee will evaluate your expenses carefully to ensure you make the maximum payment possible to repay your creditors.

A list of what are typically the top concerns of the trustee

Example ObjectionSuppose a debtor had executed a promissory note to the lender, with the real property securing the promissory note. Years later, the debtor filed for Chapter 13 bankruptcy but stated on the petition in his Schedule A/B sole property ownership. Although the debtor held the deed of trust for the real property, the creditor argued that the debtor failed to include interest payments on the total repayment plan. The creditor may also object that the plan failed to mention who was responsible for property taxes and insurance on the real property, stating that the debtor must pay these fees.

A list of what are typically the top concerns of the trustee

- Does the repayment plan follow the law?

- Is the debtor giving the best deal possible for all the creditors?

- Are the creditors getting at least what they would in Chapter 7?

- Is the debtor up to date on all of their secured assets payments?

- Does the debtor have a steady and reliable income, ensuring the ability to make the proposed payments according to the plan?

- Has the debtor made the first payment according to the plan?

Example ObjectionSuppose a debtor had executed a promissory note to the lender, with the real property securing the promissory note. Years later, the debtor filed for Chapter 13 bankruptcy but stated on the petition in his Schedule A/B sole property ownership. Although the debtor held the deed of trust for the real property, the creditor argued that the debtor failed to include interest payments on the total repayment plan. The creditor may also object that the plan failed to mention who was responsible for property taxes and insurance on the real property, stating that the debtor must pay these fees.

Continuation Meeting A continuation meeting may be necessary if the trustee or a creditor requests objections, modifications, or additional documentation. The three parties, the creditor, the debtor, and the trustee, will negotiate until they agree on preliminary acceptance of the plan, or if the plan cannot be successfully modified to satisfy all the parties even after amendments, the trustee may dismiss the case. The agreement by these three parties to the plan is only tentative, which brings us to the next step in the Chapter 13 process, the confirmation hearing.

Confirmation HearingA confirmation hearing is a proceeding where the judge examines the debtor's proposed plan to ensure it is feasible for the debtor to make payments and that it complies with the legal requirements. The trustee and creditors will still have a final opportunity to object to the plan at this meeting. The judge will consider the plan, any objections, and the fairness to creditors and make a final decision. If the judge agrees with the reorganization and repayment plan, it becomes a "confirmed" payment plan. Confirming the plan by the judge is crucial for a Chapter 13 bankruptcy as it confirms the payment reorganization the debtor and their attorney have put together.

Confirmation HearingA confirmation hearing is a proceeding where the judge examines the debtor's proposed plan to ensure it is feasible for the debtor to make payments and that it complies with the legal requirements. The trustee and creditors will still have a final opportunity to object to the plan at this meeting. The judge will consider the plan, any objections, and the fairness to creditors and make a final decision. If the judge agrees with the reorganization and repayment plan, it becomes a "confirmed" payment plan. Confirming the plan by the judge is crucial for a Chapter 13 bankruptcy as it confirms the payment reorganization the debtor and their attorney have put together.

Confirmation Hearing Locations

- 255 East Temple Street, Los Angeles, CA

- 21041 Burbank Boulevard, Woodland Hills, CA

- 3420 Twelfth Street, Riverside, CA

- 411 West Fourth Street, Santa Ana, CA

- 1415 State Street, Santa Barbara, CA

Making Payments Now that the plan is confirmed, the debtor must follow it to the letter. The debtor must make monthly payments according to the plan for the agreed amounts for the plan's duration (36-60 months). The debtor can apply for discharge after making all the required payments.

Palm Springs Bankruptcy Lawyer Christopher Hewitt Home

Palm Springs Bankruptcy Lawyer Christopher Hewitt Home