Chapter 7 Bankruptcy

Debtors must choose between two sets of exemptions when filing for Chapter 7 bankruptcy, the 703 vs 704 exemptions. Debtors with equity in their primary residence will typically use the 704 exemptions, including the Homestead Exemption, enabling them to keep their home in most cases. Debtors who do not own a home can use a wildcard exemption of up to $33,650 to exempt anything they want that is not already exempt under another category. You can keep $33,650 in cash while filing Chapter 7 bankruptcy if you do not have any other assets you want to protect and use the 703.140(b)(5) wildcard exemption. Please read our pages on the 703 vs. 704 exemptions to better understand your options and what assets can be protected during bankruptcy.

All financial assets must be declared when you file for Chapter 7 bankruptcy. The debtor must declare an asset before they can use the corresponding exemption for it. You must disclose all bank accounts when filing bankruptcy, regardless of whether they are joint or single accounts. After your petition is filed, most trustees will want to see your bank statements from every account and the exact amount in each account on the date of filing. After these account statements are provided, the trustee will not continue to monitor your accounts unless you fail to disclose any assets.

A widespread reason people file bankruptcy is when they start a small business and find themselves in debt. The business can file for Chapter 7, known as "liquidation" bankruptcy because the trustee will liquidate all the business assets. A liquidation bankruptcy is used when the owner no longer wants to continue running the business. Business debts cannot be discharged, so if you personally guaranteed any business debts, those creditors can pursue you during and after bankruptcy. Chapter 7 only allows personal debt to be discharged.

Debtors who own part or all of a business and want to file for Chapter 7 bankruptcy will face a more complicated situation. The debtor's ownership stake in the business and the value of the business will directly affect the debtor's ability to pass the means test. The debtor's assets are part of the bankruptcy estate, and a business's interest or ownership is part of that portfolio. If the debtor owns a small business, some hard assets like tools, computers, phone systems, desks, and chairs can be exempt using the "tools of the trade" exemption. If the debtor can still pass the means test without liquidating the business, they can continue operations normally during bankruptcy.

No minimum or maximum amount of debt is required to file for Chapter 7. If you pass the means test and qualify for Chapter 7, all unsecured debts can be eliminated.

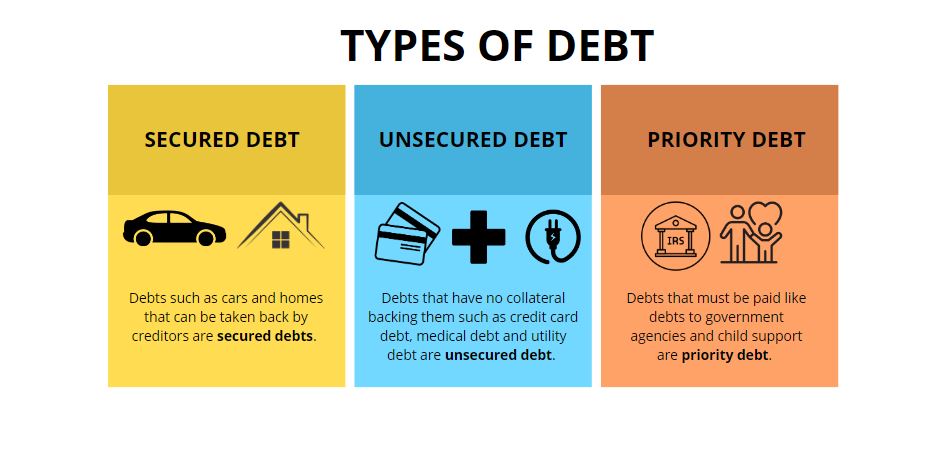

Types of Debt

When you file for bankruptcy, you address three types of debt: secured, unsecured, and priority. Secured debt means a physical asset the creditor can repossess exists to secure the debt. Houses, vehicles, boats, and even the shed in your backyard are examples of secured debt. Regardless of the exact asset, if the trustee can sell it and give money back to the creditors you owe, it is considered a secured debt. Unsecured debt is any debt not backed by any form of collateral. Unsecured debts are typically discharged in a Chapter 7 bankruptcy because there is nothing to give back to the creditor. Credit card debt, medical bills, utility bills, and personal loans are all considered unsecured debts. Chapter 7 is preferable to Chapter 13 because the bankruptcy court allows the unsecured debt to be fully discharged. The next is a priority debt, which tends to be IRS or other debts to which the federal bankruptcy court gives "priority". These usually cannot be discharged.

Dischargeable Debts

Unsecured debts can typically be discharged or eliminated in a Chapter 7 bankruptcy filing in California, as in any other state. Typical unsecured debts that can be discharged in California include:

- Credit Card Debt: Credit card balances can be discharged. When a single debtor in a joint account files for bankruptcy, the other debtor should consider paying their portion of the debt before filing.

- Medical Bills: Unpaid medical bills are considered unsecured debts and can be discharged.

- Personal Loans: Unsecured personal loans, such as payday loans or loans from friends and family, can be discharged.

- Utility Bills: Past-due utility bills, like gas, electric, and water bills, can also be included as unsecured debts in a Chapter 7 bankruptcy.

- Collections Accounts: Accounts in collections, such as unpaid parking tickets or library fines, are generally considered unsecured debts.

- Signature Loans: Loans for which you didn't pledge any collateral (like a car or house) are typically unsecured and can be discharged.

- Overdraft Fees: If you owe overdraft fees to your bank, they can often be included as unsecured debts.

- Retail Store Credit Cards: Balances on store-specific credit cards (e.g., store-branded credit cards) are typically dischargeable.

- Personal Judgments: Judgements against you with non-collateralized debts can often be discharged.

- Student Loans: It is possible to discharge student loans if the debtor can prove undue hardship.

- Child Support and Alimony: Obligations ordered in a divorce decree or family court, including child support and alimony, are not dischargeable.

- Recent Tax Debts: Most recent income taxes (within the last three years) are not dischargeable, along with other taxes like payroll taxes or fraud penalties.

- Fines and Penalties Owed to Government Agencies: Fines or financial penalties for violating the law (such as traffic tickets or criminal restitution) are not dischargeable.

- Debts Not Listed in Your Bankruptcy Petition: If you do not list certain debts in your bankruptcy paperwork, these may not be discharged.

- Debts for Personal Injury Caused by Driving While Intoxicated: If you are held liable for injuries caused by operating a vehicle (car, boat, or aircraft) while intoxicated, those debts are not dischargeable.

- Debts to Certain Tax-Advantaged Retirement Plans: Any loans or debts owed to specific retirement plans are generally not dischargeable.

- Certain Debts Arising from Divorce or Separation: Besides alimony and child support, other divorce-related debts, like property settlement debts, might not be dischargeable depending on the specifics of your situation.

- Student Loans: I have listed this twice because it is difficult to discharge student loans. I would have to understand the details of your case to make a recommendation on whether your student loans could be discharged.

Chapter 7 bankruptcy typically takes 3-4 months to complete if there are no complications. After you file, it will take about a month until your 341A hearing. However, your case can take longer (up to 6 months) if the trustee has additional questions after your 341A hearing and requests a continuation.

Cost and Fees

To file for Chapter 7 in California, you will cost between $1,500 - $2,500, including all filing fees to have a lawyer represent you throughout the bankruptcy process. In 2024, anything outside this range is either too cheap for you to get the adequate attention your bankruptcy deserves or too expensive. However, this price estimate is for a simple Chapter 7 for an individual or couple with unsecured debt they want to discharge. If you have to liquidate a business, are facing foreclosure, or have a pending lawsuit, it is reasonable to pay more than this.

Credit Impact

When filing for Chapter 7, your credit will be hurt for a few years but not ruined. Your credit score is going to drop significantly when you file for bankruptcy. You can face losing 100-200 points on your credit score immediately. It's more likely to lose a more significant percentage of points if your score is high than if your score is low. It will take a few years to recuperate a decent score. When considering filing for bankruptcy, it's essential to understand its impact on your ability to obtain credit. A bankruptcy filing will appear on your credit report as a public record for up to 10 years, making securing business or personal loans more challenging.

Determining Eligibility For Chapter 7

A debtor's ability to file for Chapter 7 bankruptcy depends on the means test. The means test was created to ensure only debtors who could not pay back the debts they owe in a reasonable time frame could file for Chapter 7. Otherwise, the debtor must pay back at least part of the debt through a Chapter 13 bankruptcy over 3-5 years. To pass the means test, the debtor must not have significant disposable income and must be under the median income in California for a household of the same size. Household size is important because larger households get considerably more exemptions. People with multiple dependents will have an easier time passing the means test because the income limit is directly correlated to the size of the family. Dependents can be both children or immediate family that you are taking care of.

Married Couples Filing Chapter 7

Couples have the option of filing for bankruptcy together or separately, and there are advantages to both methods. When doing a single filing, your partner's credit will remain unchanged, making it easier for you both to use their credit while building up your post-bankruptcy credit. Couples also have flexibility in deciding whether a dual salary makes more sense or if just one of the people in the couple should file. Because federal law does not recognize gay marriage, there is even more flexibility, and those couples can decide what is best for them by calculating whether being a couple is financially beneficial regarding their bankruptcy case.

It is not unheard of for people to file for Chapter 7 by themselves which is called “pro se”. However we do not recommend doing this as it can be a complicated process with a lot of nuances. Even those that manage to get it done without paying for a lawyer, may have missed a big opportunity on exemptions or inadvertently gotten their case dismissed because they missed crucial parts of the process or deadlines. If you want to move fast and impress your lawyer with how prepared you are, here is the basic documentation you will need but you can find a much more detailed list on our List of Documents page.

- California Drivers License and Social Security Card

- Last year’s State and Federal Tax Return

- Bank Statements (the amount and time frames can vary)

- W2’s or pay stubs or proof of all income sources

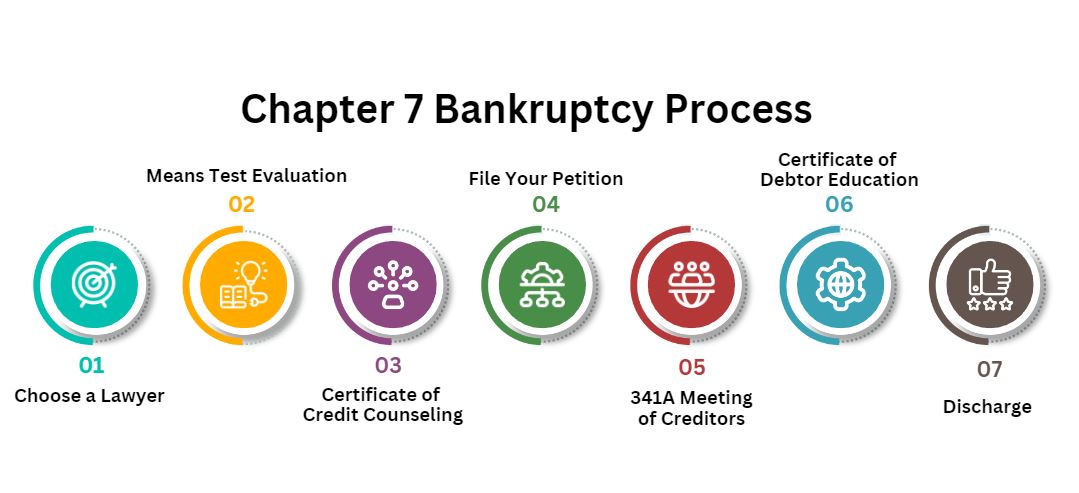

Finding a good lawyer that makes you comfortable is significant, and there are a lot of lawyers in Riverside County. I would recommend talking on the phone to at least 2-3 lawyers, and if they are "too busy" to give you the initial consultation to get to know one another, move on to another lawyer. Be sure to find a lawyer you connect with and feel comfortable with, both in how they talk to you and in their knowledge of the details of your case. Your lawyer, preferably, has filed thousands of bankruptcies in the past. You have to be completely honest with your lawyer as they work for your rights, not for the bill collectors or the court. You may be surprised how often people feel embarrassed about their situation and lie to their lawyers, putting themselves in a precarious situation.

Now, you can meet with your lawyer and explain your exact situation regarding your income, assets, debts, liabilities, spousal support situation, and urgency. Your lawyer should ask many questions about your life, in general, to understand where you are financially and what the best path forward is for you. Your lawyer will pull your credit, giving you a list of creditors in all three credit reporting bureaus. Your lawyer will add all your creditors to your petition. During this meeting, your lawyer will be able to establish whether you can pass the means test and be eligible for Chapter 7.

Before filing for Chapter 7 bankruptcy, you must take the first credit counseling class to understand the basics of money management, budgeting, and responsibly using credit. You must include your attorney's code so the system automatically credits you for taking the class.

As soon as your lawyer files your Chapter 7 petition, all your creditors are immediately notified, and you will receive an Automatic Stay. Most bankruptcy attorneys file petitions in batches because if they have ten clients filing, all the court dates will line up, making it easier for everyone. However, I will make an exception if you have an urgent situation like a foreclosure or repossession.

Now that you have filed, the Federal court will issue you several things:

- Bankruptcy Number

- Trustee

- Judge

- Date for your 341A Hearing

The 341 Meeting of Creditors is your first meeting with the court; attendance is mandatory for all debtors.

What's a Trustee?

A trustee is a lawyer who represents the court and works in the creditors' best interest. Their job is to ensure you are not taking advantage of the system, and if there is something they can sell to pay the creditors, it is their job. The trustee will also check your schedules carefully and ensure no signs of fraud. An experienced attorney knows all the trustees and judges in Riverside and can help predict differences in how they will conduct the process. A limited number of trustees are appointed to each district, and an experienced attorney in your region will know them all quite well.

From filing your bankruptcy petition until discharge will last about 3-4 months, and during that time, you must:

- Stop paying credit cards unless advised otherwise by an attorney

- Keep making mortgage and car payments

- Keep paying all utility bills

The Certificate of Debtor Education, required for Chapter 7 bankruptcy filers, must be completed post-filing but pre-discharge. This approximately two-hour course can be taken online, in-person, or by phone and covers financial literacy topics such as budgeting, money management, wise credit use, and financial planning. It is offered by providers approved by the U.S. Trustee Program, which lists eligible providers by region. Upon completion, a certificate must be issued and filed with the bankruptcy court to validate completion for debts to be discharged.

To receive a Chapter 7 discharge, you must first qualify through a means test demonstrating that your income is below the state median or you lack sufficient disposable income. Complete a credit counseling course within 180 days before filing and submit all required documents, including the bankruptcy petition and financial schedules. Attend a 341 meeting with creditors where the trustee oversees discussions about your financial situation. Post-filing, complete a mandatory financial management course. The trustee will review assets and liabilities, and if creditors raise no objections within 60 days post-341 meeting, the court will likely issue a discharge, freeing you from most debts and barring further creditor actions, with the case closing following discharge.

Filing for bankruptcy in California triggers an "Automatic Stay," a legal order that immediately stops creditors from pursuing foreclosure on your home or repossessing assets secured by debt. This automatic stay is a protective shield, preventing creditors or collection agencies from initiating or continuing any actions against you, your property, or your assets. It blocks filing new lawsuits, debt collection efforts, wage garnishments, lien placements, and property foreclosure. Additionally, this injunction stops creditors from contacting you to demand payment.

Surrender, Reaffirm, Retain, and Pay

The debtor must decide how to handle their secured debt when they file for Chapter 7 bankruptcy, and these have three options: Surrender, Reaffirm, or Retain and Pay. A vehicle would be a good example of a secured debt going through this process. If the debtor decides they do not want the vehicle anymore, they may Surrender the vehicle to the creditor, and the debt will be discharged during the bankruptcy process. The debtor may also sign a Reaffirmation Agreement with the creditor, removing the secured debt from the bankruptcy assets. It is important to note that a Reaffirmation Agreement is outside the bankruptcy, and the debtor will be responsible for the payments for the asset they have Reaffirmed. The bankruptcy can no longer discharge the debt after the debtor has agreed to reaffirm the asset. If the debtor decides to Retain and Pay, the debtor retains the collateral and does not sign a Reaffirmation agreement. The collateral will remain in the debtor's possession as long as the debtor stays current on the payments. The debtor will receive the title or gain full ownership of the collateral once it is paid in full. If the debtor defaults during Retain and Pay, the creditor will immediately repossess the asset without warning. If the asset is repossessed, the debtor will not be responsible for the deficiency between the sale amount and what the debtor owes because the actual debt was discharged during the bankruptcy.

Contact Us Today

With thousands of bankruptcy cases filed, I can help you understand these complexities and provide advice on whether you can pass the means test. With offices in Riverside, San Clemente, and Palm Desert, I can offer my services throughout most of Southern California. I speak fluent Spanish, answer the phone personally as much as possible, and will file your bankruptcy as quickly as possible if urgency is required. Contact me today for a free consultation.

Palm Desert Bankruptcy Lawyer Christopher Hewitt Home

Palm Desert Bankruptcy Lawyer Christopher Hewitt Home